This strange and meandering issue on the power & tragedy of crowds is 850 words long and it takes ~3 minutes to read. I hope you enjoy it.

The first man who, having enclosed a piece of ground, bethought himself of saying “This is mine”, and found people simple enough to believe him, was the real founder of civil society. From how many crimes, wars and murders, from how many horrors and misfortunes might not any one have saved mankind, by pulling up the stakes, or filling up the ditch, and crying to his fellows, "Beware of listening to this impostor; you are undone if you forget that the fruits of the earth belong to us all, and the earth itself to nobody. - Jean Jacques Rousseau

After consuming media and politics it seems like the realm of investment finance is the new battleground of deinstitutionalization. As in other realms a disconnect between objective truth and reality seems to be a precursor to the gradual disintegration of entrenched interests. While hedge funds are bleeding and robinhood investors are cheering, most people are standing on the sidelines, trying to discern whether we’re witnessing a revolution that will change the future of finance or a short-lived tulip-mania that will wane after the poorest generation loses their meager savings betting on stocks.

Cities are in fact the original platform that leverages the power of crowds. With the growth of cities in the past century however, urban governance has gradually moved away from the community. Furthermore some cities are now more similar to other cities on the other side of the world, than to most of their national neighbors. What Saskia Sassen calls the financialization of the urban fabric has moved beyond real estate. Consider the logistics of labor as a commodity: 25% of the population of Saudi Arabia is composed by more than thirteen million foreign workers. The Line, the latest effort to disrupt cities by drawing them differently, will probably by built by foreign workers whose families live in slums. Such extremes cannot co-exist for long.

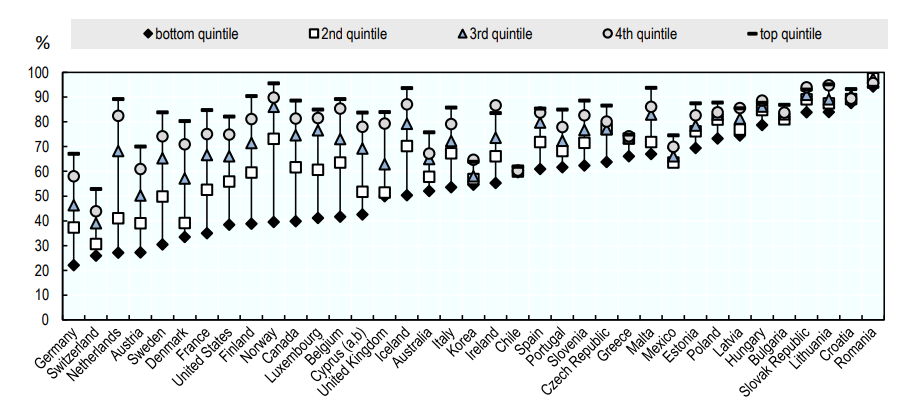

While there is a marked difference in stock-ownership versus home-ownership, it seems like the more developed a country is, the more its housing market resembles the stock market: the gap in ownership between the poor and the rich seems to grow wider. In fact the authors of the superb Rethinking the Economics of Land and Housing claim that “houses are no longer perceived as universal consumption goods but rather as vehicles for accumulating wealth.” This has given rise to what is sometimes referred to as ‘residential capitalism’. The similarities accumulate. Researchers have identified comparable psychological trends between housing and traditional investment with “amateur investors” falling prey to irrational exuberance during booms and loss aversion during busts. Not only is the housing market often securitized by large corporations, but the “regulators” of the housing market, the planners, have a major impact on the pricing of land further adding to the complexity of the problem.

Traditional models of housing construction seem more appropriate to our current conditions and can probably contribute in averting a probable cataclysmic crisis. Building societies - similar to mutuals - are financial institutions that are owned by individuals and run in the interest of their members rather than third party investors or shareholders. Individuals pool their resources in providing mortgages and in doing so eliminate the possibility of speculation. I believe that if the interests that drive the financialization of the urban realm can be curtailed, power devolution to the community level is not all that difficult. The future of the urban fabric needs to be fragmented and mutually owned. Ultimately the deinstitutionalization of media and politics has enabled unrestricted access but has not improved the information and political landscape; on the contrary the radical changes of the past decade have often left us yearning for curation.

Did you like this issue of thinkthinkthink? Consider sharing it with your network:

📚 One Book

Another Now by Yanis Varoufakis

It’s 2025 and in an alternate universe the world is thriving in a post-capitalist future; the bifurcation between the two universes happened in 2008 - right after the great financial crisis. Varoufakis gives free rain to his imagination and merges concepts from his non-fiction writing to a more accessible and effective medium: political economy sci-fi. It’s a relevant book which explores potential futures without the pressure of pragmatism. Published last September, it’s almost uncanny how Varoufakis’ fictitious crowdshorters resemble the reddit-organized retail investors who dominated last week’s newsfeeds. A short, fun and extremely relevant book.

📝 Three Links

Superstar Cities Are in Trouble by Derek Thompson

A succinct review of the remote work revolution.

Halt and catch fire Syllabus by Ashley Blewer

A historical syllabus for one of my favorite TV show. Brilliant concept!

Scientists have taught spinach to send emails by Marthe de Ferrer

Plants as sensors: a greener & more sustainable 1984

🐤 Five Tweets

This was the twentieth issue of thinkthinkthink - a periodic newsletter by Joni Baboci on cities, science and complexity. If you liked it why not subscribe?

Thanks for reading; don't hesitate to reach out at dbaboci@gmail.com or @dbaboci. Have a question or want to add something to the discussion?